The performance of publicly-traded Canadian family-controlled companies consistently exceeds that of widely held companies

PRESS RELEASES

National Bank of Canada unveils The Family Advantage Fall 2020 Report

National Bank of Canada released today its Family Advantage Fall 2020 report, which helps to better understand the inherent advantages of family-owned companies through an analysis of 38 Canadian corporations under family or founder control. The report clearly demonstrates superior long-term performance of publicly-traded Canadian family businesses.

This year, the publication features the perspectives of ![]() nine business leaders whose companies are

shaping the Canadian economy: Jenny Coco (Coco Group), Sarah

Davis (Loblaw), Stephany Fier (Silvercrest

Metals), Christiane Germain (Groupe Germain), Julie

Godin (CGI), Linda Hasenfratz (Linamar

Corp.), Madeleine Paquin (Logistec), Maureen

Sabia (Canadian Tire) and Nancy Southern (ATCO/Canadian Utilities).

nine business leaders whose companies are

shaping the Canadian economy: Jenny Coco (Coco Group), Sarah

Davis (Loblaw), Stephany Fier (Silvercrest

Metals), Christiane Germain (Groupe Germain), Julie

Godin (CGI), Linda Hasenfratz (Linamar

Corp.), Madeleine Paquin (Logistec), Maureen

Sabia (Canadian Tire) and Nancy Southern (ATCO/Canadian Utilities).

Highlights:

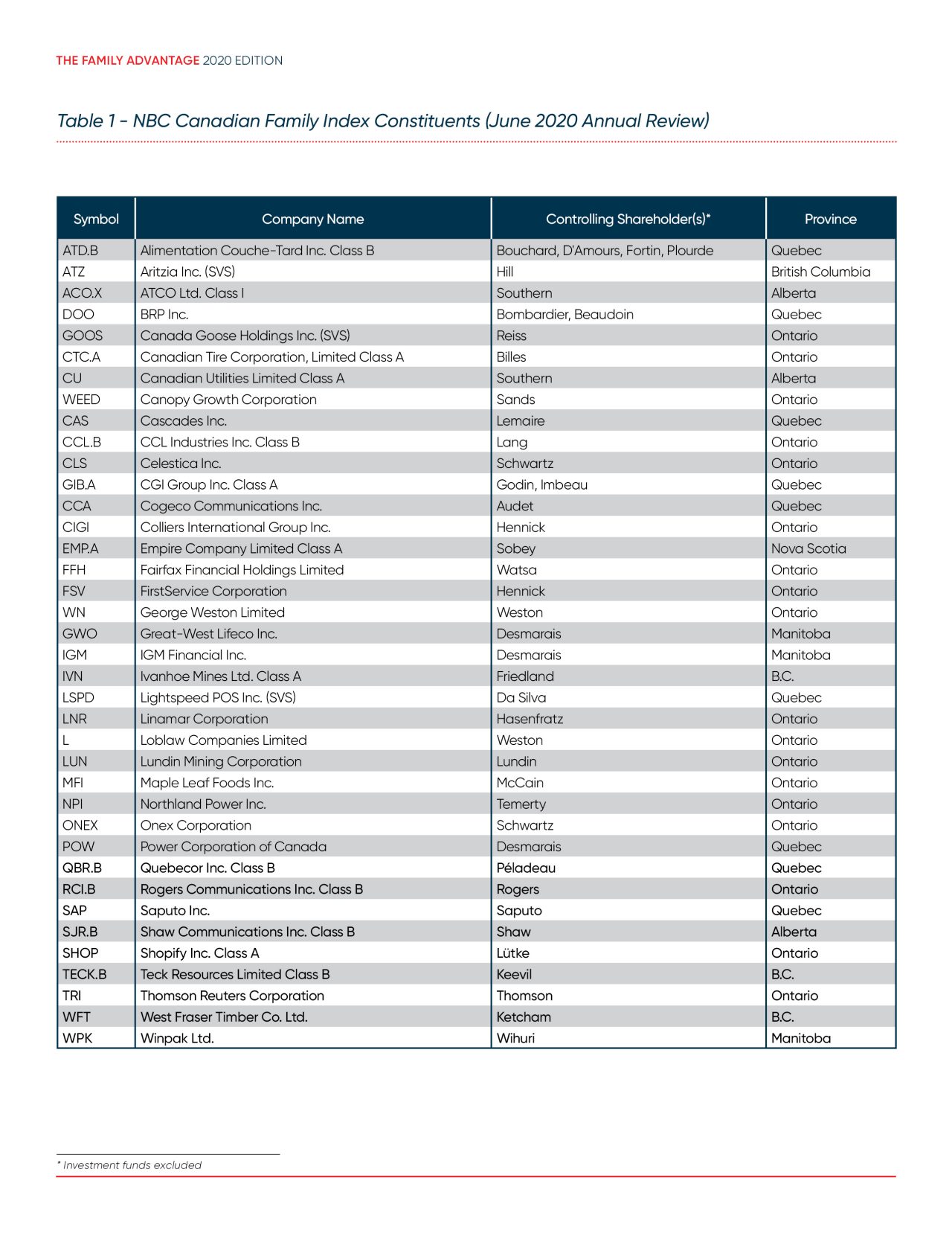

- The report features the NBC Canadian Family Index, calculated

by S&P Dow Jones Indices, which tracks and measures the

performance of Canadian companies controlled by families and

founders against the S&P/TSX Composite Index, the leading

Canadian stock market index.

- Over the past 15 years, the NBC Canadian Family Total Return Index has registered an absolute return of 180.9% compared to 140.5% for the S&P/TSX Composite Total Return Index (7.1% compared to 6.0% in annualized terms).

- Key findings:

- Public or private family-owned businesses are united by their long-term vision and their interest in maintaining their perenniality and fostering sustained growth from generation to generation. They generate long-term competitive advantages not only for their shareholders, but also for a multitude of stakeholders such as their employees, suppliers and customers, which is beneficial for the economy and community in general.

- Family businesses create an environment conducive to the emergence of women in senior management positions. Our analysis shows that 13% of CEOs of NBC Canadian Family Index companies are women versus 5% for the S&P/TSX Composite. For director positions, this percentage is 28% for the Family Index compared to 18% on average at Canadian companies.

Quotes:

- Vincent Joli-Coeur, Vice-Chairman, Financial Markets at National Bank of Canada: “We are proud to release the third report of The Family Advantage series and to announce that the NBC Canadian Family Index calculated by S&P Dow Jones Indices continues to show the strong performance of its constituent companies relative to their widely held peers and their long-term focus. The 2020 vintage of the Family Index includes 38 remarkable Canadian success stories, and the total market capitalization of these companies amounts to 22% of total S&P/TSX capitalization.”

- Dr. Karl Moore, Associate Professor, Desautels Faculty of Management, McGill University and Associate, Green Templeton College, Oxford University: “When National Bank of Canada asked me to interview some of the top women in Canadian family businesses, I was particularly delighted. I had long felt that women in family businesses had been neglected in our thinking about family business in our country. For the majority of the executives we talked to, it was mum and dad who were effectively the co-CEOs of these family firms. In those days the man had to take precedence. Today, thankfully, things are different. Daughters are increasingly the CEOs and rightly so.”

- Sarah Davis, President, Loblaw Companies Limited, believes family ownership is a key enabler of successfully delivering on transformational long-term objectives: “Patience and long-term vision, enabled by the Weston family’s ownership, were instrumental in taking a bold leap of faith in further expanding Loblaw into the pharmacy segment with our $12.4 billion Shoppers Drug Mart acquisition in 2013.”

- Julie Godin, Co-Chair of the Board, Executive Vice-President, Strategic Planning and Corporate Development of CGI, on business culture: “Culture should be a continuous evolution, not a revolution. The backbone of CGI’s culture is its commitment to ensuring that the company’s employees have the opportunity to become shareholders. The concept is that when employees are owners, they have a right and responsibility to help shape the company and they feel the accountability for delivering value for all stakeholders.”

- Maureen Sabia, Chairman of the Board of Canadian Tire Corporation, believes that the mantra of modern boards of directors needs to be changed: “Mere oversight is not enough. To adequately represent the long-term interests of shareholders and other stakeholders, a board has to be an active partner with management to create a path of long-term value generation, combined with a healthy and constructive skepticism of management.”

About The Family Advantage 2020 report

The

Family Advantage 2020 updates and enriches the 2018 edition of the

report. It presents the NBC Canadian Family Index calculated by

S&P Dow Jones Indices, which tracks and measures the performance

of Canadian companies controlled by families relative to the

S&P/TSX Composite Index, the main index of the stock market. The

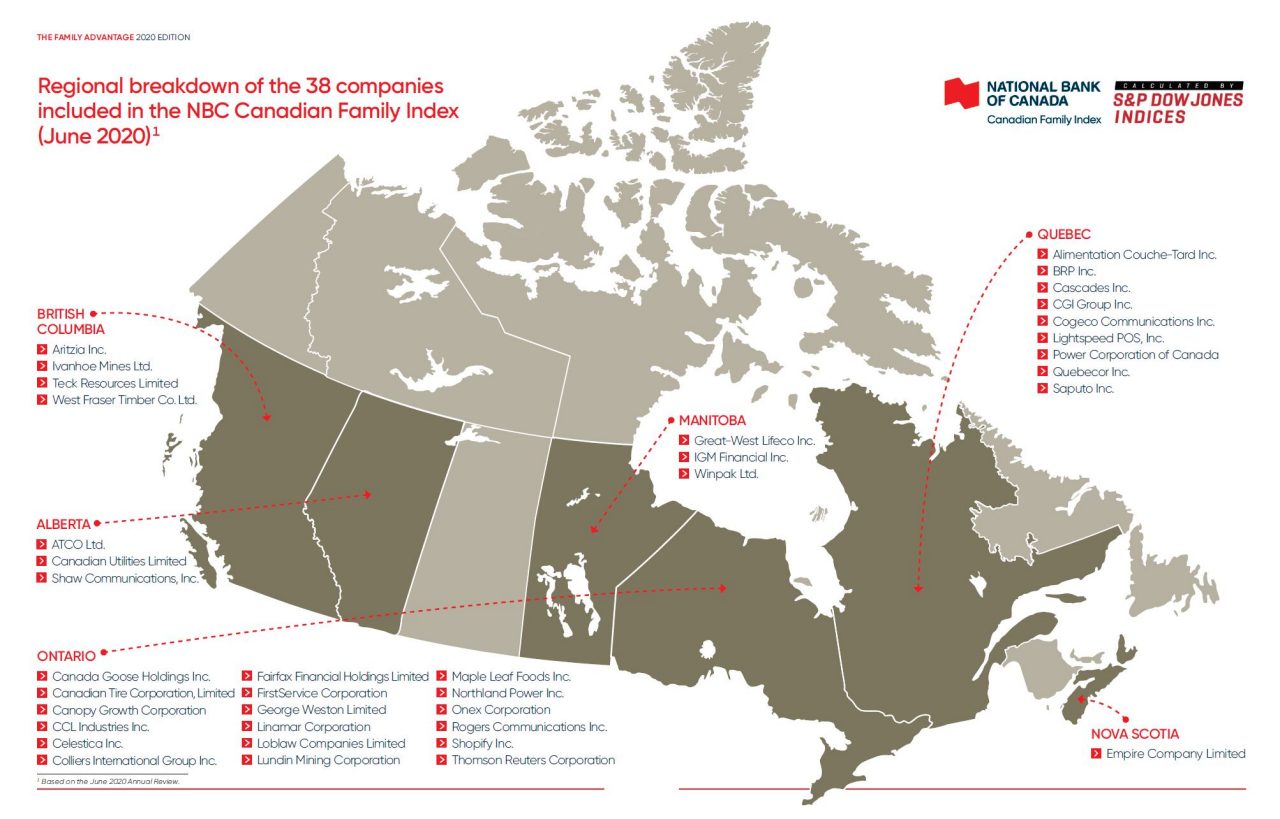

Family Index includes 38 family-owned Canadian companies in

different sectors across the country (see the full list of companies

included in the Appendix) and is based on the application of

objective quantitative criteria to an index universe provided by

S&P Dow Jones Indices, the Index calculator.

In the NBC Canadian Family Index, a company is considered to be family-controlled if the founding family or founder(s) directly or indirectly hold at least 10% of the company’s voting rights or, alternatively, if individual(s) and/or related entities hold at least 33.3% of the company’s voting rights (for more information, please see our website here .)

Vincent Joli-Coeur, Stephanie Larivière and Philippe Lefebvre Duquette from National Bank of Canada alongside academic contributor Dr. Karl Moore of McGill University and Oxford University are the co-authors and coordinators of this report.

About National Bank of Canada

With $322 billion

in assets as at July 31, 2020, National Bank of Canada , together

with its subsidiaries, forms one of Canada's leading integrated

financial groups. It has more than 26,000 employees in

knowledge-intensive positions and has been recognized numerous times

as a top employer and for its commitment to diversity. Its

securities are listed on the Toronto Stock Exchange (TSX: NA).

Follow the Bank's activities at nbc.ca or via social media such as

Facebook, LinkedIn and Twitter.

Information:

National Bank of Canada

Appendices